Company Tax Computation Format Malaysia

However such GST paid is also allowed as Input tax credit in same month and therefore net liability of tax will not increase. Defined value DV DV value for real property means market value of the real property.

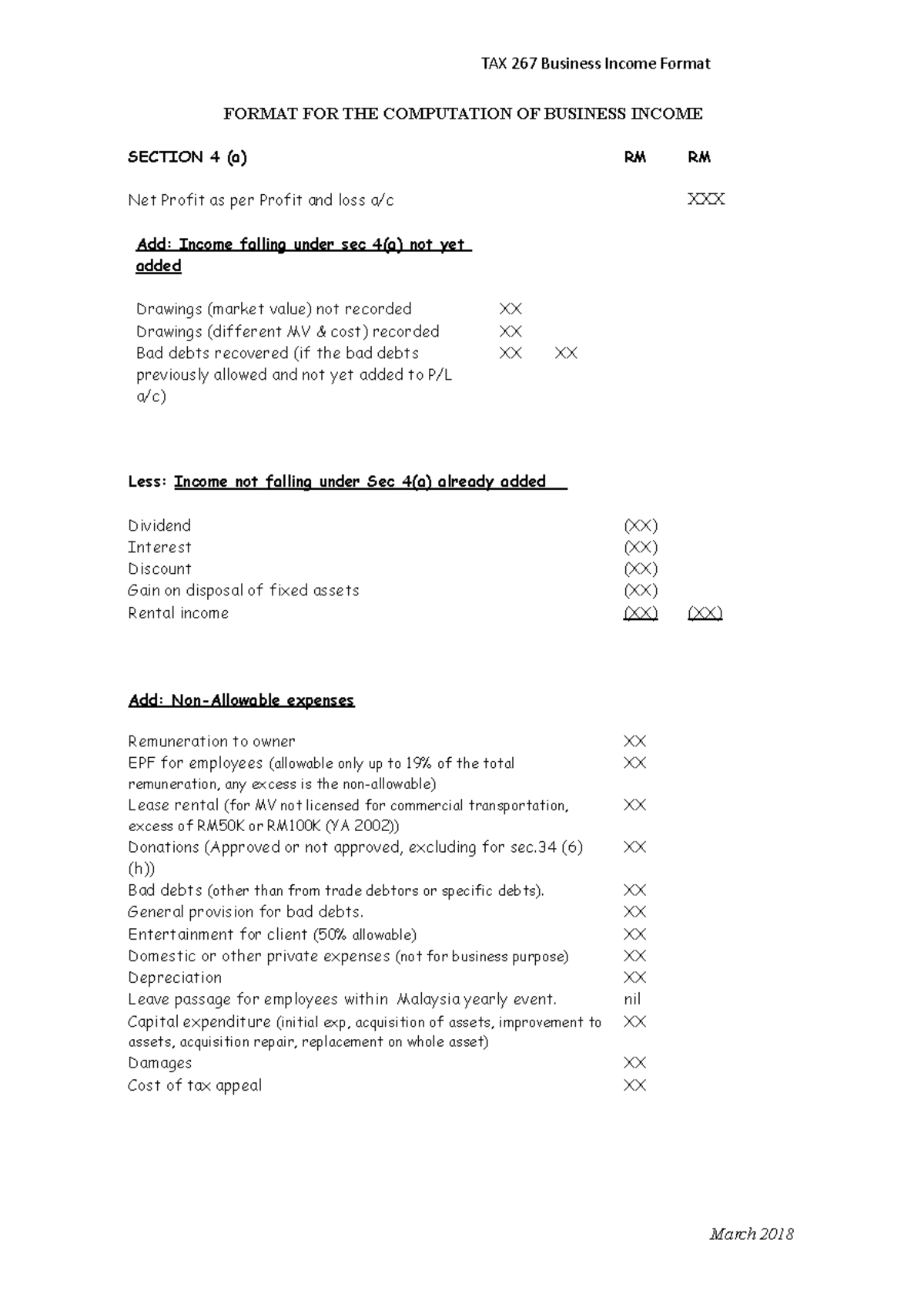

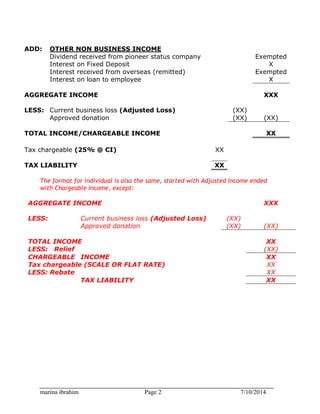

Format For The Computation Of Business Income Tax 267 Business Income Format Format For The Studocu

Automate your tax return process with CCH ProSystem fx Tax our award-winning tax prep and compliance software solution.

. Thus such document cannot be used to claim any expense as a form of tax deduction. Tax is then paid on the net which will be minus. April 9 2021 at 454 pm.

Controlled company - interpreted under Section 2 Income Tax Act 1967 ITA 1967 as a company having not more than fifty members and controlled by not more than five persons in the manner described by Section 139 ITA 1967. However if any of. Xero Tax displays the company information stored at Companies House.

Tax Guru is a reliable source for latest Income Tax GST Company Law Related Information providing Solution to CA CS CMA Advocate MBA Taxpayers. Please refer to GBI website under the Resources Tab for the 17 March 2010 presentation slides on GBI Tax Exemption. Check company information and statutory filing deadlines.

Example A trader who is registered in GST takes services of Goods Transport Agency GTA for Rs. Should she calculate TAX from 600k or from net income 360k. Buyer must not release any payment to supplier without issuing the evidence of payment such as Sales InvoiceOfficial Receipt.

Thank you in advance for your answer. For more details. When audit report can.

You declare your gross income and your expenses. Electronic filing and thousands of automatically calculating forms and schedules speed up your tax preparation and review process giving your staff more time for consulting with clients and growing your business. Miguel de Serpa Soares the Under-Secretary-General and United Nations Legal Counsel.

Therefore if the base item is nought then the green cost in the said example would be for the complete installation cost. Click the preview icon to view the accounts tax return or tax computation summary in document format. Tax incentive is on the difference in cost between the Green item and the base item.

You can edit the format of the company name and directors names if you dont want to use the Companies House format. A complete audit report need to be reviewed first by the audit officer then it will be reviewed once more by the person in charge in KL branch through email. This service is listed under the reverse charge list therefore trader has to pay tax 18 on Rs.

Mobirise is a totally free mobile-friendly Web Builder that permits every customer without HTMLCSS skills to create a stunning site in no longer than a few minutes. Format of delivery receipt does not bear any amount for the goodsservices delivered. Acting on the recommendation to prevent erosion of Indias tax base the Income Tax Act 1961 was amended in April 2001 by substituting the existing section 92 and inserting sections 92A to 92F to introduce Indian transfer pricing regulations TPR in line with Article 9 of the Organization for Economic Co-operation and Development Guidelines OECD guidelines on.

Superior Tax Comp Superior ComSec Superior TimeCost Superior SST. HRA or House Rent allowance also provides for tax exemptions. If from 360k then is there any special format for expense confirmation documents.

SUPERIOR IT SOLUTIONS SDN. The different Sections of the Income Tax Act help the salaried individuals and the self-employed people and professionals to make their rent expenditures cheaper and more desirable. Salaries of the employees of both private and public sector organizations are composed of a number of.

Format of audit report changing as the standard applied has changed from MFRS to MPERS. Non issuance of receipts is a violation of the NIRC of 1997 as. For company year ended on 31 December 2016 onwards will have to apply new format of audit report and vice versa.

Tax Secretary MBRS RPGT Time Cost Accounting Software in Malaysia. Apr 09 2021 at 854 am.

Tax Computation Format Lessor Company Name Computation Of Chargeable Incom For Ya Xxxx Rm Leasing Business Gross Income Less Wholly Exclusively Course Hero

Company Tax Computation Format 1

Format Computation 1 Xlsx Computation Of Chargeable Income Tax For Ya Xxxx Husband Wife S 4 A Business Income Adjusted Income Add Balancing Course Hero

Company Tax Computation Format 1

0 Response to "Company Tax Computation Format Malaysia"

Post a Comment